Consumer Inflation and Market Caution: An Opinion on the S&P 500’s Future

The recent chatter in trading circles has raised concerns about what comes next for the S&P 500. With fresh consumer inflation figures due on the horizon and historical data hinting at potential pitfalls, investors are suddenly faced with a mixed bag of hope and anxiety. The market, despite its recent stellar performance, may be on the verge of a significant correction if inflation warms up more than anticipated.

Many market strategists point to a scenario where an unexpected uptick in consumer prices could trigger a sell-off in equities. JPMorgan, one of the banks closely monitoring the pulse of the market, speculates that the index could tumble as far as 6,000 to 6,200 in a short-term downside scenario—a near 8% fall from the current highs. Such a correction, if it were to occur, would mark a stark reminder that the market is full of tricky parts that could quickly alter investor sentiment.

In the rest of this piece, we take a closer look at the key factors influencing market performance today, and what investors might consider as they work through managing risk in an era where inflation might be revving up its engine again.

Understanding the Market’s Current Balancing Act

For months, the S&P 500 has been cruising at near-record highs, buoyed by investor confidence and a seemingly stable economic backdrop. At the same time, however, there have been worrisome signals—ranging from a cooling yet stubborn inflation rate to persistent concerns in other sectors like employment. Recent data reveals that while job growth appears to hold up, inflation could be sagging in favor of a riskier economic outlook.

Investors have, in a sense, been pricing in a “Goldilocks scenario.” On the one hand, there remains a hope that the economy will be resilient enough to maintain growth without overheating, meaning the Federal Reserve might eventually ease up on rate hikes or even consider cuts. On the other hand, if inflation turns out to be higher than anticipated, those same assumptions might prove to be a bit too optimistic.

Those in the market must now find their way through a maze of shifting expectations. The market’s current stance is somewhat akin to treading water—striking a delicate balance between the expectation of an easing monetary policy and the looming specter of rising inflation.

Potential Fallout: The Impact of a Hot Inflation Reading

One of the top concerns is the possibility of a consumer price index (CPI) reading that comes in hotter than expected. According to experts at JPMorgan, a significant uptick in inflation could bring about a near-term correction in equity markets. This is particularly worrisome given that recent market rallies have been some of the strongest in decades.

It is essential to understand that even though stock prices have rallied to historic levels, the underlying sentiment might be on edge due to elevated investor positioning. Such positions leave little room for maneuvering when the market suddenly experiences a hit. For many, the risk is not just about declining numbers, but also about the potential fallout across sectors that could become a tangled series of events affecting both short- and long-term growth.

- Inflation figures hotter than expected could lead to accelerated rate hikes by the Federal Reserve.

- The rebound from recent market rallies might be stunted by investor overexuberance.

- Trades that were once cautiously optimistic may suddenly turn more defensive.

This set of conditions creates an environment where even a modest unexpected increase in inflation might throw off market stability. The Nasdaq and other tech indexes, while still holding near all-time highs, might also feel the tremors if investor psychology shifts to more risk-averse behavior.

Investor Sentiment and Short-Term Outlook

Investor sentiment at present is replete with hope for a comfortable economic future that balances moderate inflation with sustainable growth. However, beneath this veneer of optimism runs a counter-current of caution. Experts, including the global head of market strategy at JPMorgan, warn that the market might face a sharp correction if inflation prints out higher than anticipated in the near future.

It is crucial for investors to get into the mindset that markets are full of subtle details that can make or break long-standing positions. The current setup has investors positioning themselves optimistically for a period when rate cuts may be on the table. Should these anticipated cuts be delayed or canceled due to unforeseen inflation pressures, the market could quickly turn on itself, causing a cascade of selling orders.

An essential part of this debate involves understanding that even when news appears good at first glance, its aftermath might be surprisingly nerve-racking. Investors should therefore consider this scenario a stern reminder to remain vigilant, even when conditions seem to suggest a “Goldilocks” comfort zone.

Historical Comparisons: Market Reaction to Rising Inflation

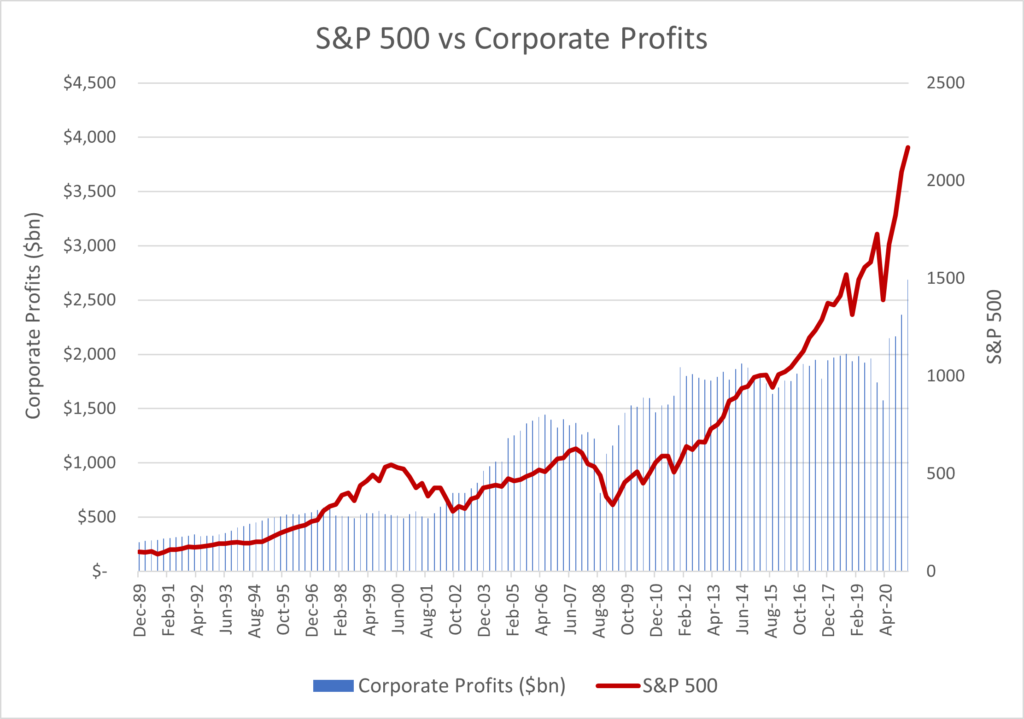

Looking back at historical precedents, one can see that markets have often struggled when inflation ticks upward more aggressively than expected. Data from previous cycles shows that while markets can handle steady, low inflation quite well, a sudden surge creates conditions that are loaded with problems—conditions that can quickly lead to significant equity losses.

A retrospective glance at market behavior during periods of rising inflation reveals a few key insights:

- When inflation was on the upswing, the S&P 500 typically experienced modest gains—often around a 2% average return.

- During cooler phases of inflation, the index’s average increase was closer to 12%, demonstrating the market’s sensitivity to even small shifts in consumer prices.

A quick table offers a simplified view of this historical data:

| Inflation Trend | Average S&P 500 Return |

|---|---|

| Rising Inflation | 2% |

| Cooling Inflation | 12% |

This table highlights why market watchers remain particularly cautious about any signs of a resurgence in inflation. The historically modest gains during periods of rising consumer prices reinforce the idea that while the market might appear robust now, even a slight moonshot in inflation figures could upend this delicate equilibrium.

Monetary Policy and Its Ripple Effects on the Market

Monetary policy has always played a crucial role in shaping investor expectations and market performance. With central banks oftentimes taking the wheel in managing liquidity and interest rates, investors are constantly trying to figure a path between anticipated rate adjustments and current market behavior.

The prospect of the Federal Reserve adjusting its policy in response to new inflation data cannot be overlooked. Should the data indicate that inflation is heating up, what follows is likely a series of nerve-racking rate hikes. These hikes, in turn, could decrease the liquidity available in the market and force investors to re-assess their positions rapidly.

Some experts argue that the market’s current robust performance comes on the back of expectations for future rate cuts—a possibility that may no longer remain viable if the CPI figures turn out to be higher than expected. This possibility emphasizes the importance of keeping a close eye on the Federal Reserve’s moves and preparing for alternative outcomes should the anticipated policy shifts be delayed.

Assessing Risk in a “Goldilocks” Market Environment

The so-called “Goldilocks scenario” is built on the assumption that the economy will cool just enough to permit rate cuts, without tipping over into a full-blown recession. However, the reality of this balancing act is loaded with issues that can quickly become overwhelming if even one factor shifts unexpectedly.

Investors need to be realistic about the challenges that come with market optimism. The current market conditions are full of confusing bits—the subtle parts of investor sentiment, high positioning, and reliance on expected monetary easing—that collectively create a fragile environment.

It is super important for investors to be aware of the following key points:

- High investor positioning can lead to sharp corrections when market sentiment reverses.

- The anticipated “Goldilocks” scenario is based on several moving parts, many of which can quickly become tangled issues if inflation trends upward.

- Even a short-term deviation in CPI data could significantly alter the market’s risk profile.

The market’s current state is a clear reminder that even in a seemingly balanced economic environment, unexpected twists and turns can demand rapid retraining of investor strategy. Those with diversified portfolios may be better prepared for downturns, but the overall reliance on continuous economic optimism remains a potential pitfall.

Weighing the Pros and Cons of a Rising Inflation Environment

As the debate over inflation and market performance continues, it becomes increasingly critical for investors to weigh the pros and cons of the current environment. While the possibility of continuing economic expansion may be appealing, there are some very real risks that could undermine even the most bullish market assumptions.

A balanced view of the situation considers the following:

- Pro: The market has shown resilience in the face of various economic challenges, with many sectors continuing to perform strongly.

- Con: Rising inflation could force central banks to adopt tighter monetary policies, thereby reducing liquidity and triggering market corrections.

- Pro: Certain sectors, such as mega-cap tech stocks, pharma, and defense, have historically managed well during periods of moderate inflation.

- Con: Overreliance on optimistic forecast models can be off-putting when even slight shifts in economic data could lead to broader market disruptions.

This balanced approach offers a roadmap for investors trying to dig into the myriad issues that complicate the current economic picture. Rather than dismissing concerns about inflation as mere background noise, a thoughtful analysis forces market participants to consider both the potential for continued gains and the risks of an abrupt market correction.

The Role of Global Events and Economic Indicators

Beyond domestic factors, global events and economic trends also play an important role in shaping market expectations. International trade dynamics, geopolitical tensions, and cross-border economic policies can all add to the list of factors that might drive investor sentiment in unexpected directions.

Financial markets, given their interconnected nature, react not only to homegrown economic indicators but also to trends abroad. With global economic recovery still in progress, any rise in consumer inflation is likely to be closely watched from an international perspective. Here’s a closer look at how these global factors might interplay with domestic inflation data:

- Geopolitical events: Political uncertainties or trade disputes between major economies can exacerbate market anxiety, especially if coupled with rising inflation.

- Economic indicators from abroad: Variations in inflation and growth data from key economies may force investors to reassess their portfolios on a global scale.

- Currency fluctuations: A rising dollar can have both positive and negative effects, ranging from increased export costs to the benefits of attracting foreign investment.

In such a scenario, understanding these global dynamics becomes key to figuring a path forward. While the domestic focus remains on the CPI and potential adjustments by the Federal Reserve, investors must also consider how the global economy might respond if its own inflationary pressures lead to monetary tightening in other regions.

Investor Strategies to Manage Short-Term Volatility

Given the uncertainty surrounding upcoming inflation data and monetary policy shifts, investors are advised to explore strategies designed to buffer against volatility. Lower volatility stocks and quality growth stocks are among the sectors favored by strategists for short-term resilience in such an environment.

Here are some strategies that might help investors manage their portfolios amid challenging market conditions:

- Diversification: Ensure that portfolios are spread across various sectors to help cushion against downturns in any single area.

- Quality Growth Stocks: Consider investing in companies with strong balance sheets, robust cash flows, and the ability to maintain earnings even when inflationary pressures tighten.

- Low Volatility Investments: Assets that exhibit less dramatic price movements can provide stability and reduce the potential shock of market corrections.

- Defensive Sectors: Sectors like consumer staples and healthcare might be less sensitive to interest rate changes, making them suitable for periods of inflation uncertainty.

Table 2 below outlines potential strategies and the benefits they might bring:

| Investment Strategy | Key Benefit |

|---|---|

| Diversification | Reduces overall risk by spreading exposure across multiple sectors |

| Quality Growth Stocks | Offers stability through strong financial health and earnings resilience |

| Low Volatility Investments | Provides a cushion against dramatic market swings |

| Defensive Sectors | Less sensitive to interest rate changes, maintaining steady performance during turbulent times |

Investors are well advised to adjust their strategies in response to new economic data, and in doing so, be prepared for those nerve-racking moments when the market suddenly shifts course. Being proactive rather than reactive can provide the necessary breathing space as conditions evolve.

Economic Outlook: Balancing Growth Prospects with Inflation Risks

Looking ahead, the economic outlook remains a subject of spirited debate. On one hand, there is the undeniable momentum from recent growth, buoyed by policy measures and robust corporate earnings. On the other, the increasing likelihood of inflationary pressures casts a long shadow over these gains.

Economists and market strategists alike agree that rising inflation is one of the critical concerns that must be watched closely. Should consumer inflation exceed expectations, the resulting pressure on monetary policy might necessitate a recalibration of growth forecasts. The risk is that what now appears to be a thriving market might rapidly transform into an environment loaded with issues that can disrupt even the most optimistic growth scenarios.

This economic balancing act is influenced by several key factors:

- Consumer Spending: A major driver of growth, consumer spending may contract if inflation becomes an overwhelming concern, particularly for households already navigating rising costs.

- Corporate Earnings: While current earnings reports have been strong, any future hits from higher interest rates could slow this momentum if borrowing costs increase significantly.

- Monetary Policy Adjustments: If the Federal Reserve is forced to adopt more restrictive policies due to rising inflation, liquidity could tighten, putting additional pressure on market valuations.

These factors suggest that the economic environment is complex, with each element interconnecting like a series of small distinctions that, taken together, can create a tangled scenario.

Financial analysts point to the potential for a modest upside in the medium term. For instance, JPMorgan remains bullish on equities overall, predicting that the S&P 500 could climb to around 7,000 by early next year—implying a 7% gain over the medium term. Such forecasts, however, rest on several assumptions that could quickly unravel if inflation does indeed keep climbing.

The Challenge of Forecasting in Uncertain Markets

Forecasting market movements in an environment that is both unpredictable and influenced by multiple external factors is full of complicated pieces. Many market watchers caution that traditional models may not fully capture the effects of rapid changes in inflation, monetary policy, or global economic trends.

One common concern is that the market’s current high valuation might be built on expectations that do not align with future economic realities. This misalignment can lead to situations where, despite favorable market conditions on paper, underlying tensions begin to surface once new data—such as a higher-than-expected CPI report—comes to light.

For investors, the challenge is to figure a path through a landscape that is perpetually shifting. Understanding that historical data and models provide only a partial picture is key to not placing too much confidence in any one forecast. The following bullet points capture some of the critical conceptual hurdles faced by market forecasters:

- Expectations of policy easing might be overly optimistic if inflation data comes back hotter.

- The window of opportunity for aggressive gains narrows quickly as investor positioning reaches extreme levels.

- Small shifts in consumer sentiment can trigger disproportionately large market movements, especially if investors are already highly positioned.

Thus, while many models predict moderate gains on average, there is always the risk that the market may experience abrupt corrections if conditions deviate significantly from these forecasts. Awareness of these challenges is super important for any investor attempting to plan for the long haul.

Lessons for the Small Business and Industrial Manufacturing Sectors

The broader implications of a potential market downturn extend well beyond Wall Street. Small businesses and industrial manufacturing firms, in particular, need to be aware of the possible ripple effects stemming from these market dynamics. While these sectors are often less directly correlated with the rapid swings of the equity market, they face their own set of nerve-racking challenges in times of economic uncertainty.

For entrepreneurs and industrial leaders, the following points offer insight into how these market fluctuations might affect everyday operations:

- Credit Availability: A tightening of monetary policy could result in higher borrowing costs, which might make it trickier for small businesses to secure financing for expansion or operations.

- Consumer Confidence: When consumer inflation comes in hotter than expected, it could dampen consumer spending. For retailers and manufacturers alike, this means anticipating a potential slowdown in demand.

- Supply Chain Management: Volatility in the markets often reflects underlying tensions in global supply chains. Businesses may need to find their way through a maze of new logistical challenges if economic conditions turn unpredictable.

These points highlight that while the stock market often steals the spotlight, the real-world consequences of high inflation and shifting economic policies can be profound and far-reaching. The need to figure a path through these potential issues is one that small business owners and industrial manufacturers, among others, cannot afford to ignore.

Automotive and Electric Vehicle Industries in a Shifting Economy

The automotive and electric vehicle (EV) sectors are also on alert as market conditions tighten. These industries, characterized by rapid innovation and significant investment, are sensitive to even slight changes in economic policy and consumer purchasing power.

For some time now, the automotive sector has balanced between optimism driven by new technologies and caution fueled by fluctuating consumer sentiment. The emergence of electric vehicles as a mainstream option—fueled by sustainability goals and governmental policies—has only added to the complexity of the market environment. Here are some of the key considerations:

- Investment in Technology: Significant capital is poured into the development of new EV technologies. Higher interest rates or economic slowdowns could put pressure on these investments, making the twists and turns of future funding critical to monitor.

- Supply Chain Constraints: The automotive sector is already dealing with supply chain issues. If inflation rises unexpectedly and impacts global trade, manufacturers may need to steer through additional challenges in sourcing critical components.

- Consumer Demand: If economic uncertainty leads households to tighten budgets, the market for more expensive, high-tech vehicles might soften, affecting overall industry performance.

These factors show that while the automotive and electric vehicle sectors continue to show promise, they are not immune to the broader economic environment that continues to be on edge. A careful recalibration of risk management strategies in these sectors is essential to prepare for any potential downturns.

Business Tax Laws and the Economic Environment: What to Expect

Another factor that industry leaders and investors must consider is the impact of business tax laws. In an environment already loaded with issues due to inflation uncertainties, changes in tax laws can add additional layers of complexity. With lawmakers frequently revisiting tax policies, companies in various sectors—from small businesses to large industrial manufacturers—must get into the specifics of how these changes might affect their operations.

Here are some of the points worth considering:

- Corporate Taxation: Adjustments in corporate tax rates can directly affect profitability, potentially influencing investor sentiment and market stability.

- Depreciation and Investment Incentives: Policies that encourage capital investment through accelerated depreciation or immediate expensing can help offset the nail-biting aspects of an inflationary environment.

- Small Business Relief: For small businesses, tax credits or relief initiatives might help cushion the blow of rising input costs or tight credit conditions, making it essential to keep a close watch on evolving legislation.

For many decision-makers, the interplay between tax laws and market conditions represents one of the more complicated pieces of modern economic dynamics. Understanding these fine shades of policy and their downstream effects is key to developing a comprehensive strategy for the coming months.

Marketing and Consumer Trends Amid Economic Uncertainty

Marketing strategies across industries are bound to feel the effects of any shift in consumer confidence. When inflation numbers come in hot, companies find themselves having to get into the nitty-gritty of their consumer outreach efforts to retain market share. The challenge is not merely about promoting a product, but about convincing a customer base that is becoming increasingly cautious about spending.

In an economic environment where every dollar counts, businesses must be adept at steering through the following areas:

- Digital Engagement: With more consumers researching online before making purchase decisions, a robust digital marketing approach becomes super important.

- Value Proposition Communication: Companies need to lay out clear, relatable messaging that emphasizes value even as prices might be under upward pressure.

- Data Analytics: By staying on top of consumer data and trends, marketers can quickly identify shifts in buying behavior and adjust their strategies accordingly.

This evolving consumer behavior calls for innovative marketing tactics that are both adaptable and targeted. The key is to figure a path that balances the need for effective advertising with the reality of a market that may soon become more volatile.

Concluding Thoughts: A Roadmap Through Volatility

As we reflect on the current state of the market, it is clear that several factors converge to create an environment where caution is as important as opportunity. With inflation data providing one of the many triggers for potential downturns, investors are encouraged to look beyond the surface of record highs and focus on the small distinctions that truly matter—investor sentiment, monetary policy adjustments, and the broader economic picture.

The coming weeks, and especially the release of the August CPI report, will serve as a critical benchmark for market direction. Should inflation come in hotter than expected, the risk of a sizeable market correction looms large. While JPMorgan and other experts offer medium-term optimism—envisaging a bounce to around 7,000 for the S&P 500—this outlook comes paired with a sober warning about the inherent risks loaded with rising consumer prices.

For investors, business leaders, and policymakers alike, the lesson is clear: remain vigilant, diversify investments, and be ready to adapt as conditions change. It is the subtle parts of the economic landscape—the fine points of consumer behavior, credit conditions, and global influences—that hold the key to understanding what the near future might bring.

Ultimately, while the market’s current rally has been impressive, history reminds us that every period of robust growth is interspersed with moments of uncertainty. As we prepare for the next chapter in this economic saga, the ability to work through these nerve-racking challenges with a balanced, well-informed strategy may well determine the winners and losers in the coming months.

The road ahead requires careful planning and an unwavering commitment to staying informed. The landscape is full of twists and turns, but with a steady hand and a comprehensive view, investors can hope to navigate these tricky parts and emerge stronger when the dust finally settles.

In summary, there is much to consider as market conditions evolve. While the potential for rate cuts and sustained growth might offer some comforts, the ever-present possibility of a sharper-than-expected inflation reading serves as a reminder to proceed with caution. By paying attention to both the macroeconomic indicators and the fine details, investors can better prepare themselves for whatever lies ahead in this intricate economic environment.

Originally Post From https://www.businessinsider.com/stock-market-outlook-sp500-prediction-drop-selloff-inflation-jpmorgan-2025-9

Read more about this topic at

Inflation expected to have climbed in August as Fed weighs …

CPI report threatens to reset Feds rate-cut plans, as market …