Assessing Utah’s Housing Market: Trends and Current Realities

Utah’s housing market has become a topic of lively debate and discussion as prices continue to rise, making home purchases feel both intimidating and full of tricky parts. In recent months, the median price for a home in Utah has reached around $512,500, marking a modest 1% increase from the previous year. Although the market appears essentially flat—a rarity these days—the higher costs and limited supply have left many potential buyers wondering if this is an off-putting time to enter the market.

Local real estate experts advise potential buyers and sellers alike not to give up in the face of these tangled issues. Instead, they recommend a careful approach that involves steady saving, monitoring of interest rates, and a clear understanding of the market’s subtle details. In many ways, despite these challenges, the market is not as nerve-racking as it might seem at first glance.

Understanding the Current Landscape of Utah Real Estate

Utah consistently ranks among the top states with expensive housing, a fact that can be attributed to several factors including the state’s attractive lifestyle, a robust job market, and stunning natural surroundings. These elements act together to limit where new housing developments can occur, creating a situation that is full of problems for potential investors and home buyers.

One of the key points to understand is that while prices have surged, the overall market dynamics remain balanced—positions for buyers and sellers are not as one-sided as commonly perceived. This equilibrium is unusual in today’s fast-changing real estate scene, and it may provide a window of opportunity for those who are patient and well-prepared.

Economic Factors Influencing Utah’s Housing Trends

Utah boasts a healthy economy with a steady influx of job opportunities and quality of life advantages that help explain its high property values. However, with this success come some tricky parts that prospective buyers need to consider:

- Growing Job Market: The state’s vibrant employment landscape is attracting new residents at a brisk pace, pushing demand upward.

- Geographical Constraints: The presence of mountains and lakes creates natural boundaries that limit available land for development.

- Stable Construction Activity: While new homes are continuously being built, supply still lags behind demand, keeping market conditions balanced but competitive.

To better understand these points, consider the following table of key economic indicators often cited by industry insiders:

| Indicator | Details |

|---|---|

| Median Home Price | $512,500 |

| Market Supply | Approximately 4.5 months of available inventory |

| Interest Rates | Currently around 6.27% as per the latest Freddie Mac data |

| Economic Growth | Strong job market and quality of life drive demand |

Geographical Constraints and Their Impact on Housing Supply

One unavoidable factor in the conversation about Utah’s housing market is the unique geographical environment. The state’s mountains, lakes, and rugged landscapes create natural limits on development, a situation that injects some confusing bits into the overall housing equation.

This limited availability of new land for building intensifies competition for existing properties. Builders are forced to work within narrow parameters, and even new developments must contend with the twists and turns of the local geography. Those looking at the housing market here must be prepared to deal with such tangled issues and appreciate that these constraints are a key reason behind the high prices.

For many prospective buyers, understanding these subtle details is essential. The geography does not just affect where houses can be built; it also influences lifestyle aspects that many find appealing, such as access to outdoor recreation, breathtaking vistas, and a balanced work and leisure environment. In this way, Utah’s physical limitations indirectly contribute to the overall quality of life, making the higher costs a trade-off for natural beauty and recreational opportunities.

How the Natural Environment Fuels Demand

The demand for properties in Utah is intricately linked to the state’s picturesque landscapes and recreational offerings. While it might appear overwhelming at times, this reality is backed up by several observable factors:

- Limited Space for Expansion: With much of the land naturally preserved, builders have fewer options to create affordable housing solutions, thus driving up the cost of existing properties.

- Emphasis on Lifestyle: Families and individuals who cherish outdoor activities are willing to invest more in a home that offers both aesthetic pleasure and convenience.

- Diverse Recreational Options: From skiing in the winter to hiking and water sports in the summer, the wide range of activities available in Utah further amplifies the pressure on limited housing stock.

Understanding these factors helps prospective buyers figure a path forward. The state’s natural constraints are not merely obstacles but also elements that provide a unique value proposition once the hidden complexities of the market are deciphered.

Market Dynamics: Balancing Buyer and Seller Advantages

Real estate veteran Adam Kirkham, a former president of the Utah Association of Realtors, offers a balanced view of the market: even though high prices and limited supply may appear overwhelming, both buyers and sellers have room to maneuver. The market appears to be in the middle—neither overly tilted in favor of sellers nor buyers.

This middle ground can be seen in several ways. While sellers benefit from a market that still favors them because of low inventory, buyers can leverage certain advantages such as favorable interest rates and ample opportunities to participate in new development projects. The essential message is clear: both parties need to be aware of the market’s subtle details and be willing to adapt their strategies accordingly.

For those involved in real estate transactions in Utah, this balance creates possibilities to work through the complicated pieces of the market. Sellers who wish to get the best returns must be ready to compete and price their properties realistically, while buyers must remain patient and prepared to act when the timing is right.

Comparing the Advantages: A Quick Look

A simple breakdown of the current advantages for both sides can help clarify the situation:

- For Buyers:

- Access to relatively stable interest rates (around 6.27%)

- Opportunities to capitalize on new development projects

- A balanced market offering room for negotiation

- For Sellers:

- Limited inventory working in their favor

- The potential for competitive offers from motivated buyers

- A market buoyed by Utah’s strong economic fundamentals and quality of life

Saving for a Down Payment: Strategies for Utah Homebuyers

One of the most nerve-racking tasks for those entering the housing market is saving enough for a down payment. Utah’s high home prices mean that buyers must plan carefully and adopt deliberate saving strategies. Although it may feel intimidating at times, real estate experts emphasize that with persistence and a strategic approach, it is possible to achieve home ownership even under these challenging circumstances.

Here are some practical tips to help prospective buyers manage their way through saving for a down payment:

- Create a Detailed Budget: Start by tracking monthly expenses and identifying areas where you can cut back. This process will help you allocate a specific portion of your income toward your down payment.

- Look for Additional Income Streams: Consider part-time work, freelance opportunities, or side projects that can supplement your regular earnings.

- Take Advantage of Employer Programs: Some companies offer assistance programs or matching contributions toward home buying, especially if you work in a fast-growing industry.

- Explore Local Grants and Assistance: Certain regions in Utah offer first-time homebuyer programs that can help with down payment funds or closing costs.

For those who need to get into the nitty-gritty of these financial preparations, having attainable milestones can break down the process into manageable steps. Making consistent contributions, even small ones, can eventually add up to substantial savings over time.

Tips to Increase Savings Efficiency

When aiming to save for a down payment, adopting a systematic approach can make the task less overwhelming. Consider the following strategies to enhance your savings efficiency:

- Automate Your Savings: Set up a direct deposit from your paycheck into a dedicated savings account. Automatic transfers eliminate the temptation to spend extra cash.

- Monitor Your Progress: Use financial apps or spreadsheets to track your savings milestones. Visual progress can be an essential motivator in sticking to your goals.

- Limit Unnecessary Expenses: Identify non-essential costs and cut back where possible—whether dining out less often or delaying impulse purchases.

- Invest Wisely: If you have a longer-term horizon before you need the funds, consider mild investment strategies that can yield higher returns than a traditional savings account while still keeping risks low.

Impact of Interest Rates on Monthly Mortgage Payments

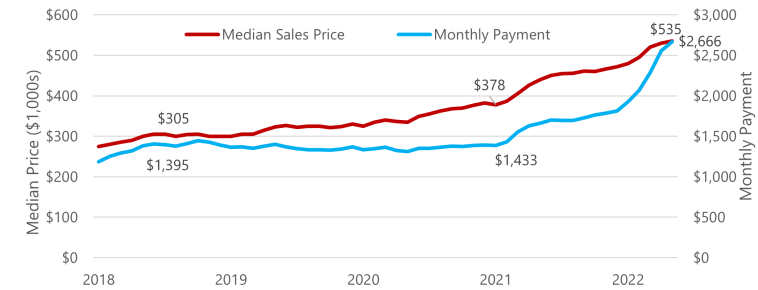

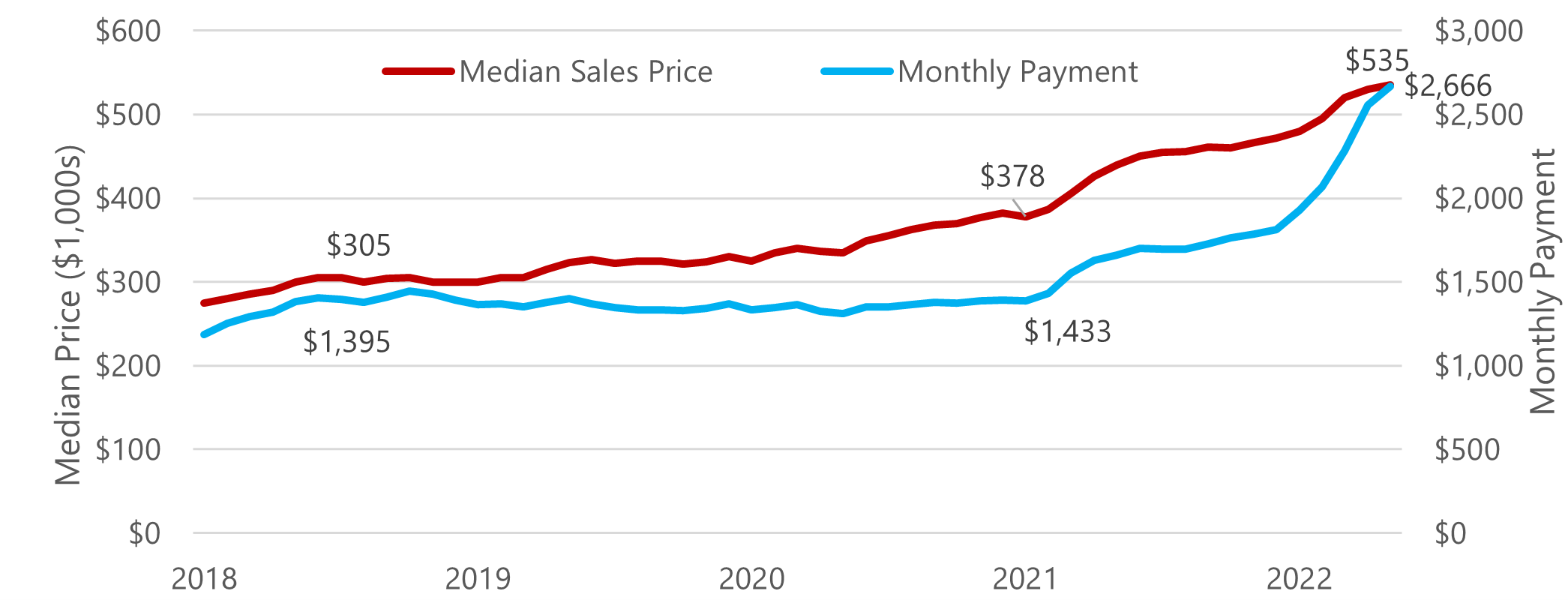

Interest rates play a super important role in determining a buyer’s monthly mortgage payment. With current data showing rates at approximately 6.27%, potential buyers have noticed that, despite the high home prices, monthly payments remain relatively manageable. This aspect of the market is part of what shapes the overall balance between sellers and buyers.

Even though mortgage interest may seem like another complicated piece in the puzzle of home buying, understanding how it influences your monthly cash flow is crucial. Many buyers benefit by locking in competitive rates, which can turn what might seem like a challenging financial leap into a more achievable goal over time.

Comparing different mortgage products is another critical step. Buyers should carefully weigh fixed-rate versus adjustable-rate mortgages, consider the term length, and factor in potential changes in interest rates over time. This approach helps to ensure that the decision aligns with individual financial situations and long-term goals.

Mortgage Rate Considerations for Utah Homebuyers

A closer look at mortgage rates can uncover some of the subtle differences that often get overlooked when buyers first enter the market:

- Fixed-Rate Mortgages: These provide steady, predictable monthly payments, which can be particularly helpful when trying to work through the brain-twisting parts of budgeting.

- Adjustable-Rate Mortgages (ARMs): Initially, these may offer lower rates, but the payment amounts can change over time. Buyers must be prepared for potential twists and turns down the road.

- Term Lengths: Common term lengths range from 15 to 30 years, with shorter terms generally offering lower interest rates but higher monthly payments.

- Closing Costs and Fees: Beyond interest rates, buyers need to be aware of additional expenses that can affect their overall payment structure.

Practical Guidelines for Buyers in a Competitive Market

For potential homebuyers in Utah, the market may appear to be full of intimidating and complicated pieces. However, the key is to stay the course and remain strategic in your approach. Whether you are a first-time buyer or looking to upgrade, there are several practical guidelines that can make the process less nerve-racking:

- Be Persistent: Even if the market temporarily seems overwhelming, persistence and continued savings can eventually lead to a successful purchase.

- Work with Knowledgeable Professionals: Real estate agents who are familiar with Utah’s unique market can provide insights to help you steer through the twisting parts and identify opportunities.

- Stay Informed: Keep a close eye on market trends and updates on interest rates. Consistent research allows for smarter decision-making when it comes to timing your purchase.

- Plan Ahead: If you can prepare a realistic timeline—from starting your savings plan to finalizing a purchase—you’ll be less likely to get caught off guard by sudden changes in the market.

Steps to Strengthen Your Position as a Buyer

Here is a straightforward outline that summarizes advisable steps for buyers in Utah’s competitive landscape:

| Step | Description |

|---|---|

| Financial Preparation | Create a detailed budget, automate savings, and monitor your progress. |

| Market Research | Study local trends, consult experts, and compare mortgage options. |

| Professional Guidance | Work with experienced realtors who can help you get around the confusing bits of the market. |

| Timing | Be ready to act when the market shows favorable signs, such as stable interest rates and increased inventory. |

Examining the Role of New Home Developments in Alleviating Market Pressure

Another aspect that contributes to mitigating Utah’s expensive housing market is the emergence of new home developments. While the high median prices and limited supply might initially suggest a seller’s market, new construction can help provide some relief by increasing overall inventory in the long term.

Builders are actively engaging in projects that are designed to overcome the geographic constraints unique to Utah. Although these developments might face their own set of challenges—such as delays or construction cost issues—they also offer renewed hope for buyers who have been waiting patiently for more affordable options. Keeping an eye on these projects, along with understanding the timeline for their completion, is a critical part of figuring a path through the modern Utah real estate landscape.

Benefits of New Developments for Prospective Buyers

New construction can bring several added benefits to the market:

- Modern Amenities: Newly built homes often include energy-efficient designs, updated technology, and contemporary layouts tailored to modern lifestyles.

- Warranty and Maintenance: Many new homes come with warranties and require less immediate maintenance, offering peace of mind to buyers.

- Community Planning: Developers sometimes include plans for community centers, parks, and other shared amenities, which enhance overall living quality.

- Competitive Pricing: Even in a high-demand market, new developments may offer competitive pricing strategies to attract early buyers, balancing the seller’s advantage somewhat.

Real Estate Experts’ Views: Buying vs. Selling in Today’s Market

Industry professionals agree that while Utah’s housing market is indeed full of mixed signals and full of problems on the supply side, the overall scenario presents opportunities for both buyers and sellers. For those contemplating whether it is a good time to buy or sell, the verdict is nuanced:

- Sellers: With inventory still relatively low, sellers continue to benefit from competitive offers. However, they should beware of pricing their properties too high or neglecting current market trends.

- Buyers: Although higher prices may at first seem off-putting, favorable mortgage rates and the promise of new developments make this an attractive time to invest if you are able to secure adequate financing and save for a robust down payment.

This balanced outlook is borne out by local experts like Adam Kirkham, who assert that neither buying nor selling is exceptionally good or bad—it all depends on a seller’s or buyer’s preparation and approach. Prospective buyers should make sure to do their homework, while sellers can benefit from the current seller-friendly conditions if they price their properties realistically.

Key Considerations for Both Buyers and Sellers

When participating in a market as dynamic as Utah’s, both sides can benefit from understanding these small distinctions that separate success from regret:

- For Buyers:

- Have a clear budget in place.

- Monitor mortgage interest rates and understand different financial products.

- Be prepared for a competitive bidding process.

- For Sellers:

- Set realistic asking prices based on current data.

- Prepare your home for showings to attract clientele.

- Coordinate with knowledgeable agents to tap into market trends effectively.

Regional Economic Developments and Their Influence on Housing

Beyond the immediate challenges of high prices and limited supply, Utah’s housing market reflects broader economic trends in the state. The continued growth in job opportunities and small business expansion contributes to a ripple effect in the property market. As more people move into the state for these very opportunities, the demand for housing intensifies further.

For local small businesses, this wave of new residents offers both opportunities and challenges. On one hand, a growing population means an expanding customer base. On the other hand, higher living costs can sometimes lead to greater caution in discretionary spending, which might affect retail and service industries. Balancing these factors is essential for those looking to invest in both the housing sector and local business ventures.

Connecting Economic Growth with Real Estate Trends

There are several key links between regional economic developments and housing trends in Utah:

- Job Creation: Increased employment opportunities lead to higher demand for both starter and family homes.

- Population Influx: With people moving in from different parts of the country, there is a cultural and economic diversification that further influences neighborhood dynamics.

- Small Business Growth: As neighborhoods become more populated, local businesses experience growth, fueling further investment in community infrastructure as well as the real estate market.

Long-Term Outlook: Finding Your Way Through Utah’s Housing Challenges

Looking ahead, experts generally expect Utah’s housing market to remain competitive, with property values continuing to be high due to constrained supply and strong demand. Although this scenario might appear overwhelming in the short term, those with a steady focus on long-term planning should find that the rewards outweigh the challenges.

From saving for a down payment to leveraging favorable interest rates, every step in the process requires careful attention to the little details that make Utah’s market unique. Understanding these subtle parts—from regional economic shifts to the impact of local geography—empowers both buyers and sellers to confidently take the wheel in their real estate journey.

For many, the process of purchasing a home may appear to be loaded with issues, but with the right preparation, knowledge, and guidance, it is possible to work through the nerve-racking elements and emerge with a decision that is both financially and personally rewarding.

What the Future May Hold for Utah Homebuyers

Even as current market conditions present their own mix of challenges and opportunities, homebuyers should take heart in the fact that many elements of the process can be managed through thoughtful planning and adherence to proven financial strategies. Key factors to keep an eye on include:

- Fluctuations in interest rates and their subsequent effects on affordability.

- The pace of new home developments that may ease the pressure on current inventory levels.

- Broader economic indicators such as job growth and population trends, which are likely to underpin housing affordability in the long run.

While the twists and turns of Utah’s housing scene might seem intense now, for those who take a methodical approach to their finances and maintain flexibility in their plans, the market can become a place of exciting opportunity rather than a nerve-racking ordeal.

Conclusion: Crafting a Future in Utah’s High-Priced Housing Market

In conclusion, while Utah’s housing market may present several complicated pieces—from high median prices to natural constraints that limit supply—it also offers significant opportunities for both buyers and sellers who are prepared to get into the nitty-gritty of this competitive environment. The current equilibrium in the market suggests that neither side holds an overwhelming advantage, provided that each party is well-informed and ready to adjust to ever-shifting conditions.

For prospective homebuyers, the key takeaway is to remain persistent. Focus on saving for your down payment, carefully track mortgage options, and seize opportunities as they arise. Through diligent planning, you can steer through the confusing bits of the process and find a home that not only meets your immediate needs but also serves as a solid long-term investment.

On the flip side, sellers in Utah can benefit from a balanced marketplace by setting realistic prices, preparing their homes for optimal presentation, and tapping into the state’s constant influx of new residents. With the support of skilled professionals and a data-driven approach, both sides can successfully manage their way through the tense yet promising landscape of Utah real estate.

Ultimately, whether you are looking to buy, sell, or simply understand the economic forces at work in Utah, the current climate underscores the need for informed decision-making. By grasping the subtle details—from geographical constraints to local economic developments—you can confidently chart your course in a market that, while intimidating at times, remains full of potential for those willing to invest in preparation and insight.

For those ready to take the plunge, remember: success in Utah’s housing market comes from a blend of careful planning, realistic expectations, and a willingness to work through even the most tangled issues. With each financial decision, you are not just participating in a market—you are crafting your own future amid one of the nation’s most dynamic real estate landscapes.

Originally Post From https://kslnewsradio.com/utah/navigate-utah-housing-market/2254871/

Read more about this topic at

How to navigate the current Utah housing market

How to navigate the current Utah housing market