Stock Market Surprises: A Closer Look at Investor Optimism Amid Mixed Economic Signals

The current state of the stock market is raising eyebrows. Even though consumer prices are on the rise and indicators suggest that the job market is slowing down, major indexes are setting record highs. In this opinion editorial, we dig into the situation to understand why investors remain upbeat despite the confusing bits in the economic data, and how anticipated moves by the Federal Reserve and shifts in interest rates are making waves across different industries.

At first glance, rising prices and a softening job market seem like a recipe for trouble. However, investors appear confident that interest rate cuts may provide a boost, leading to a buoyant market. In the following sections, we take a closer look at the key issues—ranging from inflationary pressures to tariff impacts—that are influencing this paradoxical economic landscape.

Interest Rate Speculation and Investor Sentiment

One of the central themes in today’s financial scene is the speculative belief that the Federal Reserve will lower interest rates soon. Investors are betting that even though inflation is climbing, a potential easing in interest rates will drive stock prices higher. This speculation has helped the Dow surge more than 600 points at times, lifting major indexes to record levels.

How Lower Interest Rates Benefit Stocks

Lower interest rates generally mean that borrowing costs decrease. For businesses, this situation can boost investment and expansion, while consumers might have access to cheaper credit. In turn, these factors can lead to increased corporate profits, boosting investor confidence and stock prices. Yet, the decision to lower rates is not as straightforward as it seems, given the tricky parts of the current economic situation.

- Borrowing costs decrease, benefiting both businesses and consumers.

- Cheaper loans can stimulate capital investments and consumer spending.

- Investor optimism increases even amidst seemingly off-putting economic signals.

Challenges Involved in Rate Decisions

Despite these short-term benefits, the Fed faces several tangled issues. For one, policymakers have been cautious about acting too quickly for fear of exacerbating inflation. The effect of President Trump’s tariffs on imported goods—particularly those affecting commodity prices—is another complicated piece that adds pressure to the decision-making process.

With the economy showing conflicting signals—a buoyant stock market on one hand and rising consumer prices and job market weakness on the other—the task of managing these competing priorities is anything but simple. Investors, weighing the fine points of these developments, remain attuned to the nuances of the Fed’s actions.

Tariffs and Their Effect on Consumer Prices

One of the factors contributing to the rising prices in the market is the impact of tariffs on imported goods. A notable example involves tariffs on coffee imports from Brazil, which have directly affected prices, adding more pressure on consumers and businesses alike.

Understanding the Impact of Tariffs on Everyday Goods

Tariffs can have unforeseen ripple effects throughout the economy. When countries impose tariffs on imported goods, the cost is often passed along to retailers—and eventually to consumers. For instance, retail coffee prices have jumped over 20% in the past year, and by more than 3.5% in just the last month.

Business owners and consumers face the burden of these imposed costs. Patrick Riordan, the head roaster at Palace Coffee in Texas, noted that the extra costs are like “just lighting money on fire.” Such comments underscore the nerve-racking feeling among business owners who see little to no benefit despite paying higher prices.

Key Considerations for Small Business Owners and Importers

Small business owners, industrial manufacturers, and importers are on the front lines of this issue. They must find their way through a labyrinth of tariff-induced price hikes while maintaining competitive pricing. Key considerations include:

- Evaluating alternative suppliers to offset increased import costs.

- Strategizing price adjustments to maintain profit margins without alienating customers.

- Exploring domestic alternatives or import substitution policies where viable.

These steps require a deep dive into both market research and operational adjustments. Business owners are encouraged to take a closer look at their supply chain logistics, ensuring they continue to offer competitive products while balancing cost pressures.

Long-Term Implications of Tariff Policies

From a broader perspective, the tariffs imposed by the government are loaded with issues that extend beyond immediate price increases. The long-term effects on consumption habits, inflation expectations, and overall economic stability may prove significant. Policymakers must steer through these twists and turns by weighing the short-term benefits against the potential for long-lasting economic disruptions.

Diving Into the Job Market Slowdown

Perhaps the most concerning indicator lurking behind the booming stock market is the softening in the job market. Recent data show that the pace of hiring has slowed, a trend that could have repercussions for overall consumer spending.

Signs of a Cooling Job Market

Recent reports reveal that employers added only 22,000 jobs in August, and revised data are even showing a slight decline in June – a trend not seen since 2020. Moreover, an uptick in unemployment benefit applications is signaling that layoffs might be on the horizon. This presents a somewhat intimidating picture for those who rely on stable employment to cushion economic downturns.

In simple terms, when fewer jobs are available, consumers tend to reduce discretionary spending—a trend that could undermine the positive momentum in other segments of the economy. The loss of consumer spending might eventually cool off an economy that currently relies so heavily on market optimism driven by sector-specific phenomena.

Potential Ripple Effects on Consumer Spending

Economist Julia Coronado from MacroPolicy Perspectives explains that when the engine of the job market starts stalling, consumer caution increases. The resulting chain reaction can lead to reduced spending, thereby dampening the cycle of economic growth. Some of the key repercussions include:

- Lower consumer spending on non-essential items and services.

- Increased emphasis on saving rather than spending, as economic uncertainty escalates.

- A potential shift in business strategies to cut costs, including reductions in payroll.

This slowing in hiring is a critical factor that business leaders and policymakers cannot ignore. While the stock market is currently buoyed by hopes of lower interest rates, the long-term sustainability of economic growth depends on the revival of job creation and stability.

Managing Your Way Through Uncertain Labor Markets

From the perspective of industrial manufacturing and automotive sectors, which are significant employers, lukewarm job growth could signal future capacity constraints. Companies in these industries need to get into planning modes that consider possible fluctuations in labor availability and consumer demand.

Business leaders should consider diversifying their hiring strategies, investing in automation where feasible, and exploring alternative staffing models to buffer against a weak job market. In doing so, they can find a path through these challenging times while remaining competitive and innovative.

How the Federal Reserve is Positioned Amid Economic Challenges

The Federal Reserve plays a key role at the heart of this economic drama. With inflation on the rise and the job market showing signs of weakness, the Fed’s decisions on interest rates remain central to the current market outlook. Its actions are a critical factor that both excites and unnerves investors.

Balancing Conflicting Economic Signals

The current economic data present a tricky mix: on one hand, there are rising consumer prices and slow job growth; on the other, a booming stock market driven by investor anticipation of an interest rate cut. This combination poses several tangled issues for the Federal Reserve. The challenge is to find a balance between controlling inflation and fostering economic growth.

Some of the detailed concerns include:

- Keeping inflation in check without stifling growth.

- Ensuring that rate cuts do not further depress employment figures.

- Maintaining the credibility of the central bank in a politically charged environment.

Political Influence and Its Impact on the Fed

Political interference in the workings of the Federal Reserve has always been a contentious topic. Recently, President Trump’s maneuvers—such as nominating allies to short-term positions on the Fed’s governing board and trying to block certain appointments—have added another layer of complexity to an already nerve-racking scenario.

This unprecedented level of political involvement exemplifies the delicate balance between policy independence and political oversight. The president’s attempts to exert influence over the central bank, especially through efforts to prevent appointments like that of Lisa Cook, underscore a tense relationship between the executive branch and the Fed’s traditional autonomy.

What a Potential Interest Rate Cut Means for Various Sectors

The implications of a rate cut extend far beyond the realm of Wall Street. A lower interest rate would have wide-reaching effects, including:

- Small Business: Increased access to credit can help entrepreneurs and small business owners invest in growth, despite rising operational costs.

- Industrial Manufacturing: Lower borrowing costs may encourage expansion and modernization initiatives, even as manufacturers confront supply chain disruptions and tariff pressures.

- Automotive Industry: Improved financing conditions can spur consumer demand for vehicles, particularly as electric vehicle adoption accelerates due to technological advancements and environmental policies.

- Electric Vehicles and Clean Energy: Investors might allocate more capital to emerging sectors, fostering innovation and shifting energy consumption patterns.

- Business Tax Laws and Fiscal Policy: Adjustments in corporate taxes and fiscal measures may interact with interest rate changes, affecting cash flows and profitability in unpredictable ways.

These impacts illustrate how changes in monetary policy can reverberate across different aspects of the business world, requiring stakeholders to figure a path that secures long-term stability amid immediate market volatility.

Long-Term Economic Outlook: Uncertain but Not Without Opportunity

Given the current environment, one of the most important questions for business leaders and investors is what the long-term economic outlook will look like. The immediate picture is a mix of promising signals and areas of concern—a combination that necessitates cautious optimism as well as strategic planning.

Building a Resilient Business in a Volatile Environment

For small business owners and large industrial players alike, adapting to these unpredictable conditions calls for a proactive approach. Here are several strategies that can help navigate these tricky parts:

- Diversification: Spread risk by exploring new markets and product lines.

- Cost Management: Re-examine supply chain arrangements and operational expenses to build resilience against tariff-induced price hikes.

- Investment in Technology: Embrace automation and digitalization to streamline processes and offset labor market slowdowns.

- Flexible Financial Planning: Prepare for a range of interest rate scenarios by building liquidity and maintaining access to borrowing at favorable terms.

- Strategic Hiring: Focus on building a skilled workforce while also preparing contingency plans if the job market continues to weaken.

Economic Stimulus, Consumer Confidence, and Market Rebound

While the short-term signals may be conflicting, there remains potential for a broader market rebound fueled by consumer confidence and corrective fiscal policies. When consumers have money in hand, they are likely to spend more—thereby supporting businesses and fueling further economic growth. However, this circle will only tighten if both the job market and consumer spending can be revitalized.

Policymakers and investors need to keep an eye on the following factors:

| Key Factor | Potential Impact |

|---|---|

| Interest Rate Changes | Boosts stock prices; can stimulate borrowing but may also risk higher inflation if not balanced correctly. |

| Tariff Policies | Affects the cost of imported goods; directly impacts retail pricing and consumer spending. |

| Employment Trends | Determines consumer confidence and spending power, influencing economic growth. |

| Political Decisions | May influence Fed decisions and overall market sentiment through policy shifts and regulatory changes. |

Maintaining a balanced view of these factors is super important for any business leader or investor. Developing robust contingency strategies and remaining flexible are key to seizing opportunities even amid uncertainty.

Innovations and the Role of Technological Adoption in Industry

In addition to monetary policy and labor market dynamics, technological innovation is playing a pivotal role in shaping various sectors, particularly automotive and electric vehicles. As companies embrace digital transformation and eco-friendly practices, a new era of opportunity is emerging—even in a market that appears loaded with problems.

Modernizing Traditional Industries with Technology

Modernization is more than a buzzword—it’s a necessary evolution in industries ranging from manufacturing to automotive production. Digital tools and investment in research and development are transforming operations by improving efficiency, reducing operational costs, and introducing cutting-edge products and services.

Some industry players are already adapting by:

- Implementing data analytics to optimize production and forecast demand more accurately.

- Exploring supply chain innovations that reduce dependency on volatile international markets.

- Developing environmentally friendly technologies, especially in the automotive sector, to capture the growing consumer interest in electric vehicles and clean energy solutions.

Future-Proofing Your Business in the Age of Tech

As companies tackle the subtle parts of technological shifts, today’s business leaders must take a closer look at how to remain competitive. This means not only staying informed about emerging trends but also investing in human capital to adapt and grow alongside rapid technological change.

Key steps include:

- Investing in Training: Ensure that employees keep pace with new technology and systems.

- Collaborative Innovation: Engage with other businesses, startups, and even academic institutions to exchange ideas and spearhead joint ventures in R&D.

- Agile Leadership: Develop leadership that can quickly adjust strategies as technological landscapes shift, ensuring your organization remains ahead of the curve.

This proactive stance is particularly important for sectors like automotive manufacturing which are facing a major shift toward electric vehicles. With increasing policy support for green energy and rising consumer demand for sustainable products, businesses that can adapt quickly may well secure a long-term competitive edge.

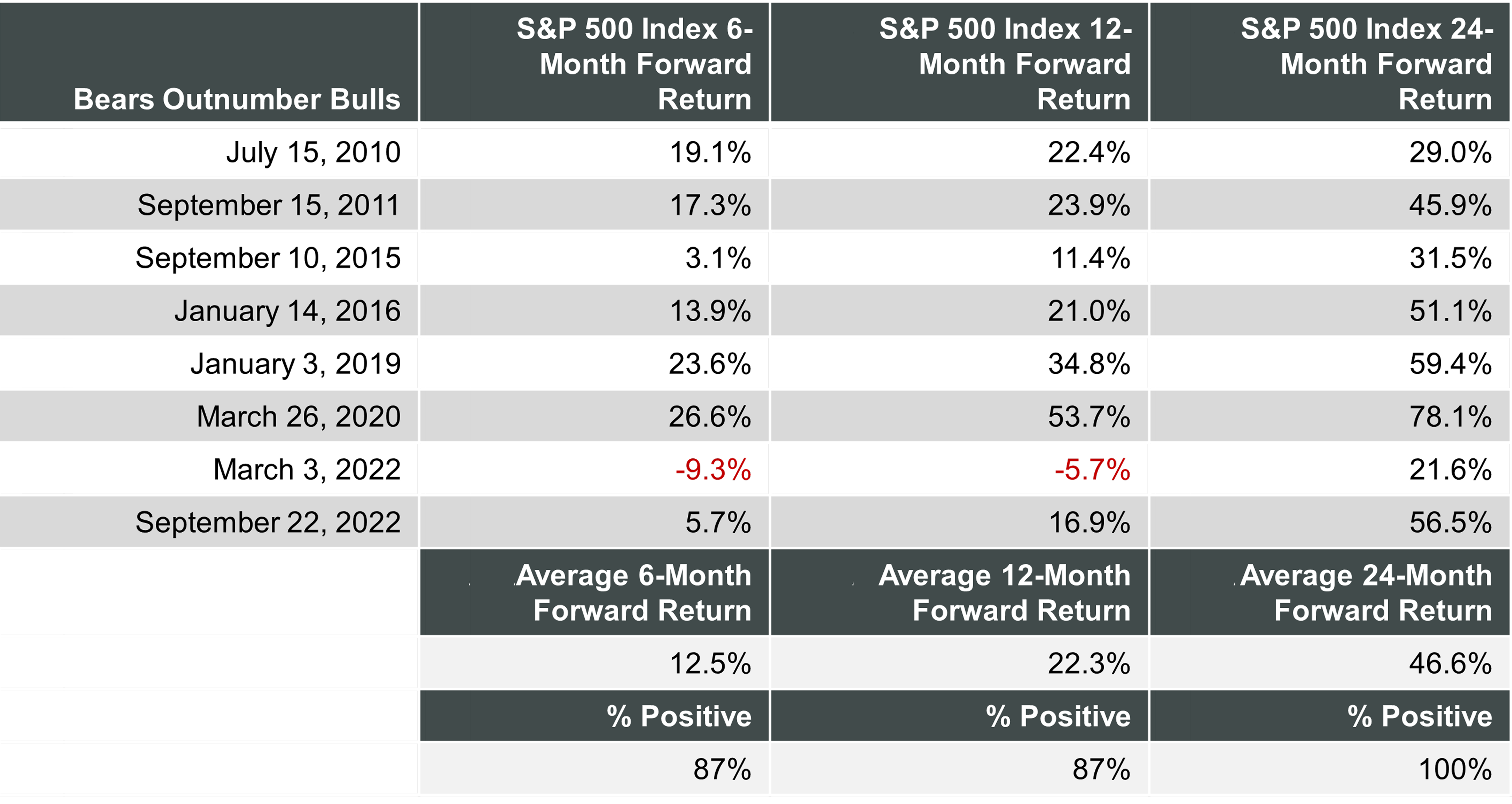

Market Psychology: Why Investors Remain Optimistic

Even while some of the economic numbers are off-putting, the broader market sentiment remains largely optimistic. Many investors are betting on short-term gains from factors such as anticipated interest rate cuts, rather than long-term stability. This optimistic tone persists despite the nagging concerns over wage growth, consumer spending, and overall economic health.

Investor Psychology in a Mixed Economic Landscape

Investor behavior is often based on a mix of market signals, the fear of missing out, and real-time economic data. In the current environment, there is a prevailing expectation that the central bank’s next move will tip the scales in favor of capital markets. Such expectations can be explained by:

- Short-Term Gains: The possibility of lower interest rates can lead to immediate boosts in stock prices.

- Risk Appetite: Even when facing subtle details of a weakening job market, investors may take on more risk expecting a market rebound.

- Belief in Corrective Policy: The assumption that policymakers will step in to balance rising inflation and slowing employment supports a bullish market stance.

Potential Pitfalls of Over-Optimism

However, relying solely on optimistic market sentiment carries its own risks. Overconfidence can result in a lack of preparedness for the inevitable downturn if the job market fails to recover or if inflation spirals further. Investors must be cautious not to overlook the nerve-racking aspects of the economic reality behind the headline figures.

Some measures to mitigate these risks include:

- Diversifying investment portfolios across multiple sectors to better manage risk.

- Keeping an eye on economic data releases that signal changes in employment trends and consumer spending behavior.

- Engaging in scenario planning to prepare for various interest rate environments.

Opportunities for Small Businesses Amid Economic Contradictions

For small businesses, the current mix of encouraging stock market performance and worrisome economic indicators presents both challenges and opportunities. While the immediate environment might be off-putting, it also offers chances to innovate and capture market share in niche segments.

Adapting Business Strategies in an Evolving Market

Small business owners are continually forced to find their way through a complicated landscape of rising costs, shifting consumer preferences, and an evolving regulatory environment. Essential strategies for navigating these conditions include:

- Reviewing and streamlining operational expenditures to offset the effect of rising input costs.

- Leveraging digital marketing tools to remain competitive, especially as consumer purchasing behavior shifts online.

- Exploring partnerships and local sourcing opportunities to minimize the risk associated with tariffs and import fluctuations.

Capitalizing on Niche Markets and Local Demand

Even with higher prices on imported goods, small businesses can discover unique local opportunities that cater to consumer needs. For instance, local cafés or specialty stores might pivot to offer locally sourced alternatives that bypass tariff-related cost increases. This approach not only appeals to community pride but can also result in lower operating costs and higher profit margins.

Some key approaches for small businesses include:

- Building a strong local brand identity that resonates with community values.

- Using local supply chains to reduce the dependency on volatile imported goods.

- Investing in customer service and personalized experiences to solidify customer loyalty.

These strategies can help small businesses find stability amid the broader market fluctuations, ensuring that they remain competitive even when larger economic indicators seem on edge.

Marketing and Business Tax Laws in a Changing Economy

Marketing approaches and business tax policies are also set to be affected by these economic conditions. As businesses adjust to a new economic reality, understanding and adapting to evolving tax laws becomes super important for long-term success.

Marketing Strategies in a Volatile Economic Environment

In an era where consumer confidence may ebb and flow rapidly, marketing must pivot to address both the nerve-racking and the promising aspects of the market. Companies are now required to:

- Enhance digital presence to capture shifting consumer behavior.

- Adopt agile marketing techniques that allow for rapid adaption to economic indicators.

- Communicate value consistently, stressing quality, reliability, and community support during times of uncertainty.

These marketing adjustments should be underpinned by a solid understanding of the subtle details of consumer psychology—they must not only highlight product quality but also reassure customers that the economic climate is being managed responsibly.

Understanding the Implications of Business Tax Changes

Business tax laws continue to play a crucial role in shaping how companies plan for growth and manage cash flows. With potential changes on the horizon in response to fiscal policy adjustments, keeping abreast of these developments is critical for decision-makers. Some points to consider:

- Tax Incentives: New policies might offer tax breaks for investments in technology, clean energy, or local production—areas that are particularly appealing to both small businesses and larger manufacturers.

- Compliance Costs: Changes to tax law may require businesses to re-evaluate their accounting and compliance strategies, potentially incurring additional costs or necessitating adjustments in operational conduct.

- Investment and Growth: A favorable tax environment can stimulate investment in research and development, enabling companies to innovate and better weather economic uncertainties.

By staying on top of these regulatory shifts and adapting quickly, businesses can turn what might seem like complicated regulatory pieces into strategic opportunities for growth.

Looking Ahead: Strategic Planning for a Mixed Economic Future

The current economic landscape, characterized by a booming stock market clashing with warning signs in the job market and inflation trends, calls for nuanced strategic planning. In the short term, investors and businesses alike are benefiting from expected interest rate cuts. Yet the long-term success of the economy hinges on addressing the underlying challenges that remain unresolved.

Constructing a Roadmap for Sustainable Growth

For many business leaders, the immediate challenge is to figure a path that embraces the positive aspects of current market conditions while also preparing for potential future setbacks. A balanced strategic roadmap may include the following elements:

- Risk Management: Develop robust financial models to project various interest rate scenarios and their impacts on cash flow.

- Workforce Development: Invest in employee training and flexible staffing strategies designed to manage a slowing job market.

- Innovation and Technology: Prioritize investments in technology that streamline operations, improve productivity, and open up new revenue channels.

- Regulatory Adaptability: Stay informed about business tax law changes and market regulations to remain agile and in compliance.

- Consumer Engagement: Strengthen marketing efforts by building trust and ensuring transparent communication with customers during uncertain times.

Staying Resilient in the Face of Uncertainty

Ultimately, the mixed economic signals we see today are both a challenge and an opportunity. While price increases, slowing job growth, and tariff pressures add to the nerve-racking atmosphere, they also force businesses and investors to take a closer look at long-standing practices. By rethinking strategies and embracing innovation, many in the business community can enhance resilience and position themselves for long-term success.

For instance, industrial manufacturers and automotive companies might explore collaborations with technology firms to streamline production processes, while small businesses can leverage digital tools to expand their customer base. The key is to remain agile and ready to respond to the subtle details of any sudden market shifts.

Conclusion: A Call for Balanced and Informed Decision-Making

The current economic scenario, where the stock market soars despite clear signs of underlying issues in the labor market and consumer pricing, reminds us that money and market movements often tell a story that is more tangled than it first appears. Investor optimism—driven by hopes of interest rate cuts—is buoying markets, but the underlying economic conditions remain loaded with issues that require careful monitoring and strategic action.

Business leaders across sectors—from small enterprises and industrial manufacturing to the automotive and electric vehicle sectors—must take a closer look at these developments. They need to manage their cash flow prudently, adapt to tariff-induced cost pressures, and invest in workforce development and technology innovation.

While this period of market optimism presents attractive opportunities, it also comes with a set of challenges that are as intimidating as they are promising. The balancing act between fostering growth and managing the impacts of rising prices and slowing job creation will require both insightful leadership and a willingness to steer through the twists and turns of today’s economic landscape.

In closing, staying informed, flexible, and proactive will be key. Whether you are an investor relying on the stock market’s current buoyancy or a business owner planning for the long haul, embracing strategic planning and agile decision-making will be essential for navigating the coming months. The path forward may be involved, but with careful consideration of every fine detail—from market trends to regulatory changes—we can all find our way through these challenging times toward a more stable future.

Originally Post From https://www.npr.org/2025/09/12/nx-s1-5538141/stock-market-booms-despite-worrying-signals-on-jobs-and-consumer-prices

Read more about this topic at

The Great Paradox of the U.S. Market!

NAVIGATING THE PARADOX: A NEW TECHNICAL BULL MARKET …