Opinion Editorial: Inflation, the Job Market, and Policy Challenges in Today’s Economy

The United States is currently at a crossroads when it comes to economic policy. Recent data shows inflation ticking upward, a steep increase in core pricing, and a softening job market that leaves both experts and everyday citizens confused about what the future holds. In this opinion piece, we’re going to dive into the nitty-gritty details of these trends, explore how various sectors are being affected, and assess the challenges facing policymakers. We will use common, everyday language to make sense of the confusing bits and tangled issues that shape our economic environment. By the end of this piece, you’ll have a clearer picture of the current economic conditions and some of the key factors that influence policy decisions.

Understanding the Rising Inflation Numbers

The latest figures released by the Bureau of Labor Statistics show that consumer prices have been on the rise. With the overall Consumer Price Index (CPI) increasing by 2.9% compared to the same month last year, and core prices (which exclude the volatile food and energy items) rising by 3.1%, the data clearly indicate that we are dealing with an economic situation loaded with issues. These increases, even though they might seem moderate at first glance, represent a series of complicated pieces that have a big impact on everyday life.

Key Price Movements in the Economy

Let’s break down some of the most essential parts of the inflation story:

- Gasoline Prices: Gas prices saw a jump of 1.9% from July to August. This isn’t just a small twist—it’s the biggest monthly increase in nearly a year, and it affects a broad range of consumers, from daily commuters to logistics companies.

- Groceries: The grocery bill is being wounded by a 0.6% increase, driven by rising prices on tomatoes, apples, beef, and other staples. This kind of steady, incremental pressure is making it more expensive for families to budget effectively.

- Travel Costs: Airfares shot up by 5.9%, while hotel room prices climbed by 2.3%. When you add this to the overall inflationary trend, it paints a picture of an economy where leisure and business travel are becoming more expensive.

- Rental and Home Costs: Rents also saw a slight uptick of 0.4%, indicating that even the housing market is not immune to the wider inflation concerns.

The Impacts of Inflation on Everyday Life

For many consumers, these increases are more than just numbers on a page—they signal real, tangible changes in their day-to-day budgets. Rising costs for essential goods such as groceries, fuel, and rent mean families must stretch their budgets further every month. This situation is particularly tricky for those living paycheck-to-paycheck.

When household budgets are squeezed, discretionary spending is often the first casualty. This means that not just essential sectors but also industries such as dining, entertainment, and minor home repairs suffer as consumers cut back on non-essential spending. The overall effect is a domino chain that can slow down economic growth across several sectors.

Tug-of-War: Inflation Versus a Softening Job Market

One of the most nerve-racking contradictions in the current economic narrative is the tension between rising inflation and a slowing job market. Typically, when unemployment begins to creep up or hiring slows, the Federal Reserve might cut interest rates to stimulate economic activity. However, the current inflationary pressures have complicated this decision-making process.

Understanding the Confusing Bits of the Job Market

Recent data paint a picture of a job market that is showing signs of weakness. Despite the unemployment rate being relatively low at 4.3%, there are signals that hiring is losing momentum. Some key observations include:

- Rising Weekly Unemployment Claims: The number of people filing for unemployment benefits has increased sharply. This uptick could be an early indicator that layoffs might be on the horizon, adding a layer of tension to an already troubled economy.

- Slowing Job Creation: If job creation slows further, it puts additional pressure on consumer spending, which in turn could worsen the already rising inflation.

- Mixed Signals: Still, the situation remains ambiguous. While we see some weakening in the job market, the overall unemployment rate stays low—adding to the complexity of finding solutions to these contradictory trends.

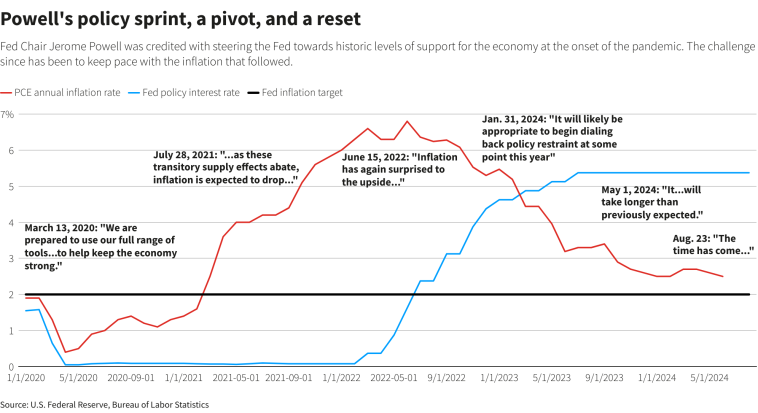

Policy Options: The Federal Reserve’s Dilemma

At the heart of the current economic uncertainties is the Federal Reserve’s struggle to address the tangled issues created by rising inflation amid a weakening job market. Traditionally, the Fed would reduce short-term interest rates if employment numbers were dropping, with the logic that cheaper credit would spur investments and spending. However, in this instance, with inflation pressures already high, a rate cut could exacerbate the situation. It’s a nerve-racking balancing act that leaves policymakers with very limited good options.

Sorting Out the Fed’s Decision-Making Process

The Federal Reserve now faces a series of complicated pieces while trying to figure a path between competing economic pressures:

- Inflation Control: The Fed’s primary mandate is to maintain price stability. With core inflation rates remaining stubbornly above the target 2%, there is significant pressure to either maintain or raise rates.

- Job Market Considerations: On the flip side, a softening job market calls for measures that stimulate employment. Rate cuts could offer a stimulus, but at the risk of further inflating prices.

To summarize the challenge, the Fed is caught between the need to tame rising prices and the need to bolster an already softening job market. This scenario leads to a policy dilemma that is as confusing as it is significant. The actions taken in the coming weeks will be critical, and every stakeholder—from financial institutions and businesses to everyday consumers—will be watching closely.

Table: Federal Reserve’s Options at a Glance

| Policy Option | Pro | Con |

|---|---|---|

| Lower Interest Rates | Stimulates borrowing and investment; could reduce unemployment | May further fuel inflation; risk of overheating the economy |

| Maintain Current Rates | Provides stability; may slowly reduce inflation without drastic changes | Could lead to stagnation if job market continues to weaken |

| Increase Interest Rates | Helps to tackle inflation effectively | May slow down economic growth and worsen job market conditions |

The Broader Economic Effects and Consumer Sentiment

Beyond the technicalities of CPI percentages and interest rate decisions, these changes have a real impact on the overall economic mood. Rising inflation affects consumer confidence and spending habits. There’s a psychological component to these trends, as people begin to feel uneasy about the future. Whether it’s the fear of further price hikes or concerns about job security, the overall sentiment is one of cautious optimism, mixed with an underlying sense of worry.

Diving into Consumer Behavior Trends

With rising prices, consumers are forced to reallocate their budgets. Several behavioral shifts have been noted, including:

- Reduction in Discretionary Spending: More money is diverted away from leisure, dining, and entertainment as households brace for continued price increases on essential items.

- Increased Price Sensitivity: Shoppers are getting smarter about their purchases, comparing prices more closely and seeking out discounts and promotions with greater frequency.

- Shift in Priorities: The focus is turning towards saving rather than spending. This behavioral change can have long-term implications on industries that depend on discretionary spending.

Such shifts in consumer behavior are critical for businesses to understand. Small businesses, in particular, might find these adjustments intimidating as they try to plan for the short term in an environment that is full of problems and uncertainties.

Implications for Business and Industrial Sectors

For small businesses and companies in sectors like industrial manufacturing and automotive, these economic shifts introduce both challenges and opportunities. It’s important to recognize that inflation does not affect all sectors in the same way, and understanding these subtle differences can help business leaders make more informed decisions.

Industry-Specific Challenges and Strategies

Let’s take a closer look at a few key sectors:

- Automotive and Electric Vehicles: Rising inflation increases the cost of materials and labor, pushing up the manufacturing cost of vehicles. For electric vehicle producers, the challenge is twofold—catering to sensitive consumer markets while managing increasing raw material costs. Industry leaders are coming up with innovative ways to streamline production, negotiate better supply chain deals, and pass on only part of the increased cost to consumers.

- Industrial Manufacturing: For factories and plants, the escalating prices of energy and raw materials squeeze profit margins. Many manufacturers are now investing in energy-efficient technologies and automation to reduce long-term operating costs. However, these investments require significant upfront capital, which can be intimidating in an unpredictable economic period.

- Small Business Concerns: Small businesses are often the most vulnerable in periods of inflation. With thinner margins and less negotiating power with suppliers, these businesses must get creative—whether it’s by exploring local sourcing, utilizing digital marketing or revising pricing strategies—to stay afloat during these trying times.

Strategies for Small Business Adaptability

It is super important for small businesses to remain agile in a loaded environment like this. Some strategies they might adopt include:

- Cost Management: Businesses are re-examining their operating expenses, focusing on trimming unnecessary costs while preserving quality and service.

- Supplier Negotiations: Establishing long-term contracts with suppliers at fixed rates can help hedge against further price increases.

- Digital Transformation: Embracing e-commerce and digital marketing enables small businesses to reach a broader audience at lower costs. Tools like CRM systems, inventory management software, and online payment gateways are proving to be a key advantage.

- Consumer Engagement: Engaging with customers via social media, loyalty programs, and community events can build resilience in brand loyalty during economically tense times.

Political and Regulatory Tensions: The Wider Landscape

The economic scene cannot be separated from the political and regulatory environment. In recent months, political pressures, including comments from high-ranking officials, have added another layer of confusing bits to the policy mix. For instance, recent attempts to influence Federal Reserve appointments have stirred debate, not only among economists and market participants but also within the broader political discourse.

Examining the Political Influence on Economic Policy

This political tension creates an atmosphere on edge, where every decision is heavily scrutinized. Some of the snapped political issues include:

- Tariff Policies: The tariffs imposed in the previous years still resonate within the economy. While many imported goods saw slight price increases as a result, these measures had broader implications for international trade and domestic production.

- Control Over Monetary Policy: Recent moves to intervene in the personnel decisions of the Federal Reserve, such as efforts to fire a Fed governor, have added layers of tension to an already complicated situation. The courts intervening to limit these moves have reinforced the independence of monetary policy, but the political undercurrents linger.

- Legislative Uncertainty: Even as the Federal Reserve prepares to make decisions on interest rates, legislative debates continue over how best to support a slowing economy while keeping inflation in check. This has created a sort of tug-of-war that affects both policy implementation and public sentiment.

Impact on Regulatory and Business Environments

For businesses and consumers alike, the political load can make planning even more nerve-racking. The interplay between legislative decisions and regulatory oversight means that companies must be more vigilant in monitoring changes that could affect everything from credit availability to international trade agreements. For example:

- Uncertainty in Trade Policies: Domestic manufacturers might face supply chain challenges if tariffs or trade regulations change unexpectedly.

- Financial Market Volatility: Political instability can lead to short-term market volatility, affecting investments and potentially increasing the cost of capital for businesses.

- Regulatory Compliance: New legislative measures can impose additional regulatory burdens on small and medium-sized enterprises, further stretching already tight budgets.

Looking Ahead: The Road to Recovery and Stability

Although the current economic environment is full of problems, there is reason for cautious optimism. Both policymakers and business leaders are actively working through these issues to find solutions that can create a more resilient economy. The period ahead is likely to be marked by policy adjustments, continued innovation in business practices, and perhaps a gradual stabilization of inflation figures.

Short-Term and Long-Term Policy Strategies

In the short term, the Federal Reserve is expected to react to the latest figures with measured steps. Analysts are predicting a potential cut in the short-term interest rate from 4.3% to around 4.1% in the upcoming meeting. This decision is designed to strike a balance by offering some relief to the job market while not completely fuelling further inflation.

Looking long-term, there are broader strategies that policymakers and business leaders can adopt to steer through these challenging times:

- Enhancing Supply Chain Efficiency: Businesses can look at ways to improve logistical operations and inventory management, reducing sensitivity to price swings in raw materials and essential goods.

- Investing in Workforce Development: To address the slowing pace of job growth, both the public and private sectors need to invest in training and upskilling workers. This approach can help mitigate the short-term impacts of a softening job market and prepare the workforce for future challenges.

- Encouraging Innovation: Through supportive regulatory policies and incentives, innovation in sectors such as renewable energy, digital commerce, and advanced manufacturing can spur new business opportunities and improve overall economic resilience.

- Enhancing Financial Literacy: Ensuring consumers and business leaders understand the hidden complexities of economic policy can help reduce the feeling of being overwhelmed by sudden changes, making it easier to plan for the future.

Bullet Points: Key Takeaways for a Resilient Economy

- Inflation is rising, pushing up the cost of everyday essentials such as gas, groceries, and travel.

- A softening job market is complicating traditional policy measures, as the Federal Reserve weighs the risks of cutting rates against the danger of further fueling inflation.

- Businesses, especially small enterprises, need to adopt agile strategies to cope with rising input costs and shifting consumer behaviors.

- Political and regulatory tensions add another layer of complexity to the economic landscape, affecting domestic and international business operations alike.

- Both short-term adjustments and long-term policy innovations will be needed to create a more resilient economic framework.

Reassessing the Intersection of Economic Policy and Social Impact

An important aspect of this discussion is not just the technical details of inflation or the job market, but what these changes mean for everyday people. When inflation increases faster than wage growth, families feel more pressure to adjust their spending habits. They must get around the challenge of balancing bills, savings, and day-to-day expenses—a task that can be both intimidating and overwhelming.

Analyzing the Social Repercussions

The human side of this economic story is full of subtle details that directly impact quality of life. For instance:

- Household Budget Strains: Steady price increases on essentials like food, energy, and housing force families to reallocate funds from savings or non-essential spending to cover basic needs.

- Impact on Consumer Confidence: The feeling that the economy is on a shaky path can dampen consumer confidence, which in turn may reduce overall economic activity as households become more cautious about spending.

- Financial Stress: The uncertainty and small twists in everyday costs add a layer of stress that can have long-term effects on mental and physical health.

Measures to Support Affected Communities

Efforts to mitigate these adverse effects can come from both government initiatives and grassroots community programs:

- Government Relief Programs: Financial aid targeted at low and middle-income households, energy assistance programs, and food subsidies can help cushion the blow from escalating prices.

- Community Initiatives: Local organizations can offer financial literacy workshops, community buying groups, and shared resource programs that allow residents to benefit from collective buying power.

- Small Business Support: Programs aimed at helping small enterprises navigate tougher economic conditions—such as grants, tax relief, or subsidized loans—are essential in creating a buffer against wider economic disruptions.

The Role of Economic Forecasting and Business Adaptation

Business leaders, especially in sectors like manufacturing, automotive, and retail, must take a proactive approach in figuring a path through these challenging conditions. Economic forecasting has become even more critical during these times, as companies work through the imbalanced signals of a rising inflation rate and a slowing job market. These forecasts, though based on historical data and current trends, are always tinged with uncertainty—making the decision-making process more of an art than an exact science.

Strategies to Strengthen Business Resilience

A multi-pronged approach is needed to get into the tangled issues and make your way through this economic maze:

- Invest in Technology: Automation and digital transformation can reduce operating costs in the long run and improve efficiency even during times of economic strain.

- Diversify Supply Chains: Reducing reliance on a single supplier or region can help mitigate risks associated with international trade issues and sudden price hikes.

- Enhance Customer Engagement: Building strong customer relationships through transparent communication and tailored services can help businesses maintain loyalty even as consumers become more price-conscious.

- Flexible Financial Planning: Creating contingency plans, including emergency funds and flexible budgets, can help businesses manage unexpected changes in the cost structure.

Table: Business Adaptation Techniques

| Strategy | Benefit | Potential Challenge |

|---|---|---|

| Investing in Automation | Increases efficiency and reduces long-term labor costs | High upfront investment costs |

| Diversifying Supply Chains | Reduces dependency on single markets; lowers risk | Can be complex and take time to implement |

| Enhancing Customer Engagement | Builds brand loyalty and steadier revenue streams | Requires consistent effort and innovative strategies |

| Flexible Financial Planning | Provides a safety net during unexpected downturns | May require tighter short-term budgets |

Global Comparisons: What Can We Learn?

Looking beyond our borders, many other developed economies are wrestling with similar economic challenges. By examining their responses, we can find useful insights to make our way through our own set of economic obstacles. For example, countries with different policy mixes have either focused on aggressive rate cuts or a combination of fiscal stimulus and tight monetary policy as a countermeasure against rising prices.

International Policy Responses and Their Implications

Let’s consider a few examples from abroad:

- European Markets: Several European nations have adopted precautionary measures to curb inflation by controlling public spending while initiating modest rate adjustments. Though these measures come with their own twist and turns, they highlight the importance of coordinated fiscal discipline.

- Asian Economies: In parts of Asia, rapid technological adoption and export-driven growth strategies have helped offset some of the domestic inflation pressures. Their approach is instructive for businesses emphasizing digital transformation and supply chain resilience.

- Lessons for the U.S.: For American policymakers, these global examples underscore the need for a balanced approach—one that carefully weighs both domestic pressures and international trends as the country strives to maintain economic stability.

Conclusion: Finding a Path Through the Economic Maze

The economic landscape today is replete with contradictory forces—a stubborn inflation rate that continues to rise amid a job market that is showing signs of weakness. This situation creates a set of confusing bits that leave both consumers and business leaders working through tangled issues as they try to plan for the future.

Policymakers, particularly those at the Federal Reserve, are facing a nerve-racking challenge as they consider how best to balance these competing demands. With rising costs on essentials like gasoline, groceries, travel, and housing, everyday consumers feel the pressure every time they step out the door. Businesses, especially small enterprises, must find your way through these complicated pieces by adopting agile strategies that emphasize cost management, supplier negotiation, digital transformation, and consumer engagement.

On the international stage, lessons from abroad suggest that a balanced and coordinated policy response can help mitigate some of the negative impacts of inflation while supporting growth in an unpredictable environment. Whether through tactical rate adjustments or strategic investments in technology and workforce development, the road ahead is one that requires both careful planning and a willingness to adapt to a rapidly changing economic reality.

Ultimately, the conversation about inflation and economic policy is not simply a technical debate confined to the halls of the Federal Reserve. It is a discussion that touches the lives of everyday Americans—from those struggling to make ends meet to business leaders steering their companies through challenging times. As we continue to monitor these economic trends, it is essential for all stakeholders to remain engaged, informed, and ready to work through the nerve-racking challenges that lie ahead.

In our view, while the current economic signals may be full of problems, they also serve as a wake-up call—reminding us that the path to prosperity is rarely a straight line. It is through understanding the fine points of economic policy, staying adaptable in the face of change, and making cautious yet innovative decisions that we can hope to emerge stronger in the long run.

Final Thoughts

The twists and turns of today’s economy may be intimidating for those trying to plan for the future. However, by staying informed about the key price indicators, monitoring the subtle details of consumer behavior, and analyzing the broader policy environment, we can better prepare for what lies ahead. Whether you are a policymaker, a business leader, or simply a concerned consumer, now is the time to take a closer look at the economic landscape, understand your own position within it, and work towards making thoughtful, informed decisions.

While the journey through this economic maze is far from easy, it is one we must all navigate with careful deliberation and a commitment to finding practical, effective solutions for the challenges that confront us. Only through collective awareness and proactive engagement can we hope to steer through these confusing bits and complicated pieces, forging a more stable and prosperous future for everyone.

Originally Post From https://www.fox32chicago.com/news/inflation-consumer-price-index-august-2025

Read more about this topic at

U.S. inflation worsened last month, putting Fed in difficult …

CPI Shows Pace of US Inflation Likely to Keep Fed …