Understanding the Latest UK Consumer Confidence Dip

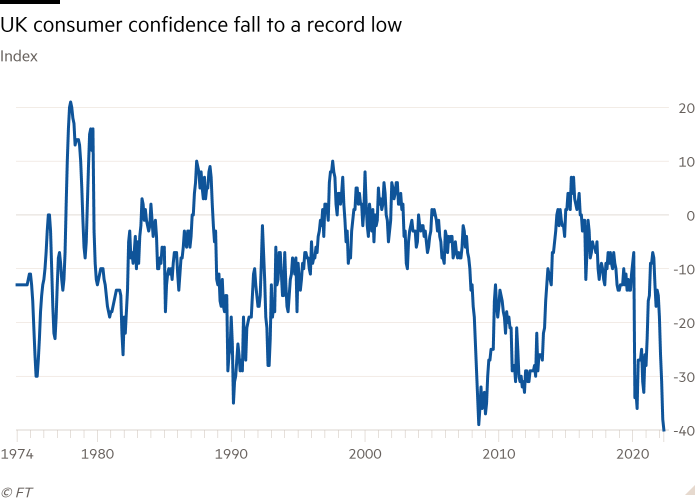

The latest figures from Deloitte indicate a notable drop in overall UK consumer confidence, reflecting a mix of cautious optimism and growing concerns among everyday consumers. The survey data, collected from over 3,200 respondents aged 18 and above between 13 and 16 June 2025, shows that consumer sentiment has slipped by -2.6 percentage points overall, marking the first noticeable decline since October 2022. In many ways, this marks a critical moment for the UK economy, where consumers seem to be grappling with a mix of good news on certain fronts and tough, tangled issues on others.

While there was a surprising uptick in confidence towards the state of the UK economy by +3.9 percentage points compared to the previous quarter, other facets of consumer sentiment saw significant drops. A closer look reveals that concerns over job security and personal finances are at the forefront, suggesting that consumers are feeling the pinch amid persistent inflation and a high cost of living.

UK Consumer Spending Trends Amid Rising Inflation and Economic Shifts

The decline in consumer confidence reflects deeper, underlying factors that are influencing spending habits. This editorial takes a closer look at how inflation, a weakening labour market, and the pressure of everyday bills are impacting the way consumers allocate their funds.

Changing Patterns in Essential and Discretionary Spending

In the second quarter of 2025, while essential spending fell by -4.6 percentage points, discretionary spending—including leisure activities like holidays, dining out, clothing, and footwear—saw a modest rise. This shift suggests that while consumers remain cautious about their finances, they also continue to place value on experiences that offer a break from everyday economic pressures.

This balance between cutting back on necessities and still choosing to spend on leisure goods or services underscores the mixed mood amongst consumers. The following table highlights some of these changes in spending patterns:

| Spending Category | Percentage Change | Key Observations |

|---|---|---|

| Essential Spending | -4.6% | Reduced spending on utilities, groceries, and daily necessities |

| Clothing & Footwear | +6.6% | Consumers willing to invest on personal appearance and comfort |

| Holidays & Hotels | +4.7% | The desire for a break and escape from the ongoing economic pressures |

| Dining Out | +2.8% | Small but noticeable increase driven by a search for affordable luxuries |

While these numbers provide a snapshot of current consumer spending, the deeper story lies in what is motivating these choices. With everyday costs on the rise, many consumers are trying to figure a path that balances saving and enjoyment.

Working Through the Tricky Parts of Job Security Concerns

One of the most striking aspects of the recent consumer confidence survey was the drop in sentiment regarding job security, which fell by -4.8 percentage points. This decrease in confidence is compounded by additional doubts over job opportunities and career progression, which also descended by -3.9 percentage points. These drops indicate a shaky labour market that has put many consumers on edge.

The increased employer costs coupled with a shifting economic landscape have left many feeling that their career futures carry a degree of uncertainty. While the economy shows signs of resilience in certain areas, the impact of these tricky parts on employment cannot be understated. To better understand consumer concerns, consider these key factors:

- Employment Uncertainty: Rising employer costs and a frustrated labour market have left many consumers questioning the stability of their current jobs.

- Stagnant Earnings: Despite some improvements in economic activity, wages have not kept pace with the rising cost of living, intensifying fears about future income growth.

- Rising Debt Concerns: Consumers reported a -3.7 percentage points decline in confidence regarding their level of personal debt, a reflection of how mounting financial pressures are weighing on individual finances.

Given these factors, the challenges facing the workforce today are not just about finding new employment opportunities but also about managing the hidden complexities that come with ensuring a stable financial future amid increased pressures.

Industrial and Automotive Sectors: Caught in the Economic Crossfire

While the immediate focus of the survey is on consumer confidence, the ripple effects touch several key industries that are the backbone of the UK economy. Industries such as automotive and industrial manufacturing, often seen as indicators of broader economic health, have not been immune to these trends.

The automotive sector, for instance, while emerging with innovative models like electric vehicles, is still facing consumer hesitation due to economic uncertainty. Prospective buyers are finding it a nerve-racking experience to commit to big-ticket purchases when their job security is in question and when financing options seem less attractive amid high-interest rates. Similarly, industrial manufacturing companies are tasked with working through tangled issues surrounding supply chain disruptions and volatile demand.

Some key points for these sectors include:

- Capital Investment Hesitations: Consumers and businesses alike are cautious, delaying major investments as economic tensions add extra layers of complication to decision-making.

- Consumer Financing Concerns: With a decline in confidence regarding levels of personal debt, financing options for automobiles or industrial equipment face tougher scrutiny.

- Technological Transitions: Innovations such as digitalisation in patient care or advancements in electric vehicles remain promising but require the market to stabilize before mass adoption.

Ultimately, these sectors must find their way through these challenging times by focusing on strategic innovation and robust after-sales support, ensuring that both consumer and business interests are met in a balanced manner.

Impact of Inflation and the High Cost of Living on Everyday Consumers

One of the underlying drivers behind the drop in consumer confidence is persistent inflation, which has turned everyday spending into an intimidating balancing act. Although there was a slight improvement in sentiment regarding the overall state of the UK economy (+3.9 percentage points), this positive shift is more than offset by how inflation has tightened budgets across the board.

Inflation, particularly when it remains stubbornly high, affects consumer spending in several concrete ways. People are more mindful of spending where every pound counts. Here are some of the specific impacts inflation has on consumer behavior:

- Reduced Essential Spending: Many households are cutting back on non-negotiable expenses like groceries and utilities to make ends meet.

- Shifts Toward Value: There is an observable trend where consumers are trading down from premium brands to more affordable options without sacrificing quality.

- Preferences for Experience Over Goods: While essential spending is slashed, there is a slight uptick in discretionary spending focused on leisure. This highlights a desire to retain some lifestyle enjoyment even during economic uncertainty.

For consumers, making your way through such a climate means constantly assessing priorities, weighing each purchase decision carefully, and often embracing change. Even in the face of overwhelming inflationary pressures, the resilience that consumers demonstrate by re-prioritising their spending is a testament to their will to maintain quality of life despite the considerable twists and turns of current economic conditions.

How Consumer Confidence Shapes the Broader Economic Picture

The interplay between consumer confidence and the overall health of the economy is both intricate and fascinating. When consumers feel uncertain about their job security and personal finances, spending patterns change, which in turn can affect sectors ranging from retail to real estate.

Consumer confidence is not just a standalone metric; it is a key barometer that influences business decisions, lending practices, and even marketing strategies. Here are a few ways in which consumer sentiment feeds back into the economy:

- Investment Decisions: Businesses closely follow consumer confidence trends to adjust inventory levels, manage supply chains, and invest in innovative technologies.

- Credit Availability: Financial institutions use consumer sentiment metrics to fine-tune lending criteria, impacting everything from mortgages to business loans.

- Marketing Strategies: Companies in sectors like automotive and industrial manufacturing are adapting their marketing tactics to address what consumers are currently thinking about—focusing on value, durability, and long-term benefits over flashiness.

Ultimately, this intricate interplay shows that consumer confidence is not static. It evolves based on both macroeconomic factors and personal experiences. As economic conditions improve—if wages rise and if inflation eases—consumer confidence could very well see a strong bounce back. However, until then, businesses and policymakers alike must work through these tangled issues to support recovery.

Examining the Role of Labour Market Fluctuations in Shaping Confidence

The drop in consumer confidence, particularly around job security and career prospects, cannot be examined in isolation. It is deeply linked to how the labour market is performing amid external pressures such as increased employer costs and global economic tensions. With a job market that many describe as nerve-racking right now, the subtle parts of employment, including recruitment trends and wage dynamics, deserve closer scrutiny.

Recent insights from experts indicate that the labour market is under considerable strain. Employers are facing higher overhead costs, and consumers are aware of these rising pressures. This has led to a palpable shift in job-related confidence, as summarized below:

- Career Progression Fears: Consumers are no longer as optimistic about climbing the career ladder, primarily due to uncertainty surrounding employer investments in human capital.

- Fluctuating Recruitment Trends: With companies tightening their budgets, there has been a slowdown in hiring, which is reflected in consumer sentiment regarding job opportunities.

- Changing Employer-Employee Dynamics: As companies pass on rising costs, job security is becoming an increasingly complex issue burdened with confusing bits of economic policy and employer strategy.

This situation underscores a need for both employers and employees to find their way through these turbulent times. Businesses must be transparent and supportive while workers might consider enhancing their skills or exploring newfangled fields as a hedge against further economic shakiness.

Strategic Recommendations for Businesses Amid Consumer Uncertainty

Given the current landscape, companies operating in sectors such as small business, industrial manufacturing, automotive, and electric vehicles need to adjust their strategies. The mixed signals from consumer confidence surveys should prompt businesses to work through the tricky parts of market adaptation with agility and clear-headed planning. Here are several recommendations:

- Enhance Customer Engagement: Promote loyalty by emphasizing value, reliability, and quality in your products and services.

- Invest in Digital Transformation: Embrace technological solutions that can streamline operations and improve customer experiences. As demonstrated by sectors like healthcare, digitalisation is key to staying competitive.

- Offer Flexible Pricing Strategies: With discretionary spending showing resilience, ensuring your pricing models accommodate both necessities and little luxuries can help capture a diverse customer base.

- Focus on Workforce Stability: Addressing concerns about job security internally can have a spillover effect on external consumer sentiment, as a stable, motivated workforce tends to deliver consistent performance.

These strategies, if implemented thoughtfully, can form an essential foundation for businesses looking to weather short-term uncertainties while setting the stage for longer-term growth. The ability to manage your way through these economic twists and turns will be central to success now and in the future.

Understanding the Consumer Insight: A Closer Look at the Deloitte Survey Findings

The Deloitte Consumer Tracker provides an insightful glimpse into how everyday Britons are feeling about a wide range of issues—from their jobs and debt levels to their overall perception of economic health. While the survey shows a decline in confidence in several areas, it is also a reminder of the resilience that can often emerge in times of economic stress.

Key findings from the survey include:

- Overall Confidence Down by -2.6 Percentage Points: The decline marks a significant turning point after a period of recovery from the more turbulent times of late 2022.

- Job Security Concerns Leading the Decline: A -4.8 percentage point drop in job security sentiment reflects the heightened sensitivity to employment stability.

- Debt Concerns and Consumer Caution: Despite a drop in confidence regarding personal debt, levels remain higher than those seen a year ago, indicating that while consumers are cautious, optimism may still linger somewhere under the surface.

As consumers respond to these mixed signals, the story becomes one not of inevitable decline but of an evolving landscape. The survey underscores that even as consumers cut back on certain expenses, their pursuit of meaningful experiences remains a priority. This balance illustrates how consumers are managing your way through a complex mix of challenge and opportunity.

Working Through the Little Details of Economic Recovery

The outlook for the UK economy remains on edge, with several key factors that will determine the pace of recovery. While improvements in some areas like the state of the UK economy are encouraging, the underlying issues—including unsettling employment conditions and persistent inflation—continue to pose challenges.

A few subtle parts that warrant close attention include:

- Monitoring Inflation Trends: With inflation expected to remain above the levels seen in global counterparts for the foreseeable future, businesses and consumers alike need to stay alert and flexible.

- Assessing Business Optimism: The latest Deloitte CFO Survey indicates that while there is growing confidence among UK finance leaders, this optimism must be matched by sustainable policies and operational adjustments.

- Adapting to Consumer Shifts: Firms must work through the tangled issues of evolving consumer preferences—especially as people shift from high-cost necessities to experiences that enrich their lives.

For many, the path to economic recovery involves more than just waiting for inflation to subside or the labour market to stabilize. It is about embracing a more agile, consumer-focused approach that addresses these little twists head on. Only by getting into these fine points can companies be well prepared for the complexities that lie ahead.

Embracing Technological Shifts to Rebuild Consumer Trust

In sectors like industrial manufacturing and the burgeoning field of electric vehicles, technological advancements are playing a critical role in reshaping consumer perceptions. From digitalising the patient experience in healthcare to integrating advanced AI systems in production, innovation remains a super important lever for rebuilding consumer trust.

Technological integration can help companies offer more reliable, efficient services while addressing some of the nerve-racking concerns that today’s consumers face. Key advantages include:

- Improved Transparency: Digital tools provide clearer insights into supply chains, pricing, and service levels, which can help rebuild consumer confidence.

- Enhanced Customer Engagement: With robust data analytics, businesses can tap into fine shades of consumer behavior to create personalized experiences that resonate.

- Greater Operational Efficiency: Technology allows companies to reduce costs and offer competitive pricing that appeals to consumers balancing tight budgets against a desire for quality.

Adopting these technological solutions is not only a tactical move but also a strategic necessity. By leveraging digital tools and innovative processes, companies can provide a more seamless experience for customers, addressing the little details that are super important in shaping long-term loyalty and economic resilience.

The Road Ahead: Finding Your Path in an Uncertain Economy

At its core, the current state of consumer confidence in the UK underscores both the challenges and opportunities that lie ahead. While significant hurdles remain—ranging from job security fears to the persistent impacts of inflation—the underlying themes of resilience and adaptability continue to define the consumer landscape.

Working through these challenging economic twists and turns calls for a multi-pronged approach, including:

- Policy Initiatives: Government policies that address labour market concerns and try to ease the pressure of everyday costs will be central to lifting consumer confidence.

- Business Agility: Companies must continually adjust pricing, enhance customer service, and embrace digital innovation to maintain and grow their market share during these tense times.

- Consumer Support: Financial literacy programs and transparent communication about product and service offerings can help consumers feel more secure about their choices.

For now, the mixed pulse of the UK consumer market serves as both a cautionary tale and a reminder of the market’s inherent resilience. While consumers may currently be feeling the pressure of higher living costs and uncertain job prospects, their willingness to invest in value and experience indicates a readiness to chart a new course when the economic winds shift.

Conclusion: Staying Resilient Amid Economic Uncertainty

Consumer confidence is a powerful indicator of a nation’s economic pulse. The recent decline in the UK’s consumer confidence index serves as a wake-up call for businesses, policymakers, and consumers alike. As we see job security concerns drop sharply and discretionary spending shift in unexpected ways, it’s clear that both the strengths and the challenges of the consumer landscape are intertwined.

The path forward will require all stakeholders to take a closer look at the key factors shaping consumer sentiment. From addressing the intimidating job market uncertainties to managing the effects of persistent inflation on everyday spending, the journey ahead is layered with twisted issues and nerve-racking decisions.

However, the current environment is not without its silver linings. Improved business optimism, advancements in technology, and a renewed focus on creating meaningful consumer experiences are all signals that there is still plenty to be hopeful about. Each step taken to support consumer confidence—whether through better government policies, innovative business strategies, or community support initiatives—will contribute to a more resilient economic future.

In conclusion, while the economic outlook may seem tangled and unpredictable at times, consumers continue to show a remarkable ability to adjust their spending habits and priorities. As businesses and policymakers work together to provide stability and support, there is every reason to believe that this period of uncertainty will eventually pave the way for a more robust and dynamic economic recovery. The ability to make your way through these tricky parts, adapt to subtle changes, and embrace innovation will be the super important ingredients for both short-term resilience and long-term success in today’s challenging economic environment.

Originally Post From https://www.deloitte.com/uk/en/about/press-room/uk-consumer-confidence-falls-for-the-first-time-since-q3-2022.html?icid=top_uk-consumer-confidence-falls-for-the-first-time-since-q3-2022

Read more about this topic at

Consumer confidence falters as financial expectations fall …

Surveys of Consumers